After several years of discussion with HMRC, the PDA has been approved by the Commissioners for HM Revenue and Customs under Section 344 of the Income Tax (Earnings and Pensions) Act 2003 with effect from 6 April 2018. PDA members are now allowed to claim tax relief as a deduction from earnings from employment for their PDA subscription, less the amount of £15 each year which is deemed attributable to the PDA Union.

This is a significant boost to the value of PDA membership to pharmacists and means that the real cost of membership, after receiving tax relief will reduce, while the benefits of PDA membership continue.

The benefits of membership

Membership of the PDA gives employed and locum pharmacists a strong independent voice in sectors where employers have an established and significant influence, and where the profile of pharmacists has historically been lower than that of some other healthcare professionals.

The PDA works to bring a balance to these environments across the UK, with each additional PDA member, giving the combined voice of the profession more profile and influence. The PDA is now the largest pharmacist membership body in the UK. Through research, policy development and campaigning the PDA also influences pharmacy and the wider world of employment, directly and by working with partners across the UK and internationally.

In addition, PDA membership supports each member with:

- Legal Defence Costs Insurance

- Professional Indemnity (PI) Insurance

- Public Liability Insurance

- The PDA Service Centre which provides professional and employment advice

- Access to PDA Education and other training and events

- INSIGHT magazine and other communications, including risk management guidance and more

- Membership of the PDA Union

- Locum Contract Dispute Resolution

- A donation to Pharmacist Support

- Discounted membership of up to four Equality, Diversity and Inclusion networks

- The PDA Plus range of additional discounts and offers, secured using the purchasing power of our 30,000 + members.

How much tax relief you can claim each year?

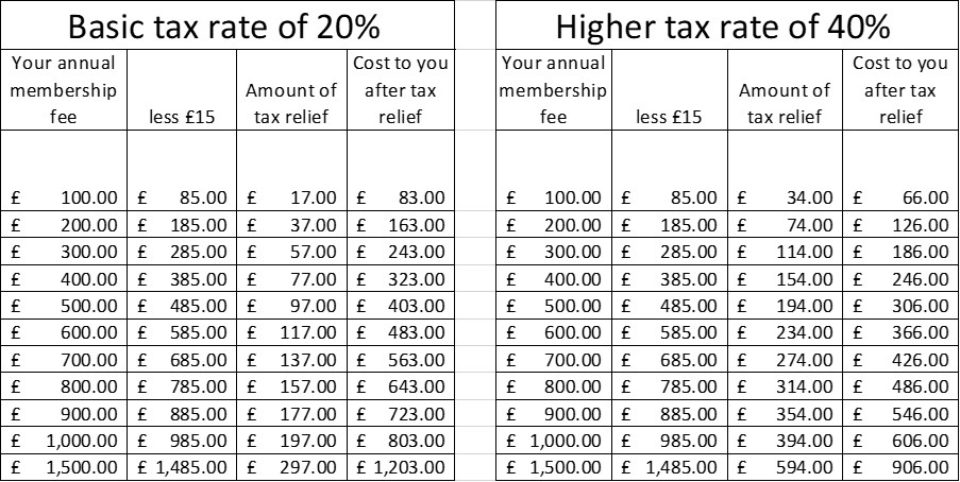

HMRC have agreed that PDA members can apply for tax relief on almost all their membership fee, with only £15 of the annual membership not applicable for tax relief. Hence members can claim tax relief on the costs of membership minus £15 per year.

There is some variation in tax rates around the UK, however, for illustration purposes the following tables show what this means for those on 20% or 40 % tax rates:

The £10 membership fees for PDA equality networks (the National Association of Women Pharmacists (NAWP, the LGBT+ Pharmacists Network, the BAME Pharmacists Network and the Ability Network – for pharmacists with disabilities) are also not included in the scope of the HMRC decision.

Retrospective claims

The HMRC decision takes effect from the 2018-19 tax year and therefore pharmacists who were members of the PDA during tax years 2018-19, 2019-20 and 2020-21 can claim retrospective relief against their membership fees for those three years. Please remember to deduct £15 and the cost of any equality network membership fees from each year’s claim.

What to do with your tax relief

Though the PDA team have been working towards this arrangement for some time, members will not have been expecting this tax relief. The PDA hope that after a challenging year for every pharmacist, members will enjoy an unexpected amount of extra money to spend on themselves or their family.

Should any member want to donate all or some of their tax relief to a good cause the PDA have created these links to donate to pharmacists’ charities:

- Pharmacist Support – an independent, trusted charity providing a wide variety of support services to pharmacists and their families, former pharmacists and pharmacy students. in Great Britain. Donate via PDA’s JustGiving page here.

- The Pharmacist Advice and Support Service, known as PASS, helps pharmacists, ex-pharmacists, their dependents, and pre-registration trainees in times of need in Northern Ireland. Donate via PASS’s donation page here.

How to claim

Click here to learn how to claim your tax relief

Not yet a PDA member?

If you have not yet joined the PDA, we encourage you to join today and encourage your colleagues to do the same.

Membership is FREE to pharmacy students, pre-regs and for the first three months of being provisionally registered/newly qualified.

Read about our key member benefits here.